Axis Bank Share Price Drops After Q1 FY26 Earnings Miss: Should You Buy or Hold?

Axis Bank’s Q1 FY26 earnings have offered a mixed view for investors, as the lender reported a 4% YoY drop in net profit despite solid growth in revenue and other income. The markets responded with a mild correction, reflecting investor disappointment over the sharp rise in bad loan provisions and a dip in key profitability metrics.

- Latest Share Price (July 17, 2025): ₹1,159.85, down ~0.7% on the day

- 52‑Week High/Low: ₹1,318 / ₹934

- Volumes: Approx. 74k shares (vs. 189k average)

- 1-Year Range: ₹934 – ₹1,318

- Market Sentiment: Cautious to Neutral after earnings

- P/E Ratio: ~12.8x; P/B: ~1.9x

- Dividend Yield: ~0.09% (₹1/share in July 2025)

Key Q1 FY26 Financial Highlights – Axis Bank

| Metric | Q1 FY26 | Q1 FY25 | YoY Change |

|---|---|---|---|

| Net Profit | ₹5,806 crore | ₹6,035 crore | ▼ 3.8% |

| Net Interest Income (NII) | ₹13,560 crore | ₹13,448 crore | ▲ 0.8% |

| Operating Revenue | ₹20,818 crore | ₹19,232 crore | ▲ 8% |

| Other Income | ₹7,258 crore | ₹5,783 crore | ▲ 25% |

| Fee Income | ₹4,920 crore (est.) | ₹4,470 crore (est.) | ▲ 10% |

| Trading Income | ₹1,420 crore | ₹406 crore | ▲ 249% |

| Operating Profit | ₹11,515 crore | ₹10,106 crore | ▲ 14% |

| Operating Expenses | ₹9,303 crore | ₹9,125 crore | ▲ 2% |

| Provisions | ₹3,948 crore (est.) | ₹2,039 crore | ▲ 94% |

Fundamentals & Valuation

- P/E: ~12.8–12.9×

- Book Value: ~₹604/share, P/B ~1.9×

- ROE: ~16.3%

- Dividend Yield: ~0.09% (last dividend ₹1 on July 4, 2025)

- Analyst Target: Median ~₹1,396 (high ₹1,691, low ₹1,159)

- Intrinsic Value Estimate: ~₹1,564, indicating ~25% discount to current ₹1,160

What Drove the Performance?

Positives:

- Revenue growth remained robust, led by a 25% jump in other income, especially from trading gains (↑249%) and fee income (↑10%).

- Operating profit growth (↑14%) outpaced expenses, indicating solid core business momentum.

- Asset growth continued with total assets rising to ₹16.03 lakh crore, and advances up ~14% YoY.

Negatives:

Net Profit fell 3.8% YoY, missing LSEG analyst expectations (₹6,373 crore).

Net Interest Margins (NIMs) likely compressed, affecting interest income.

Bad Loan Provisions nearly doubled to ₹3,948 crore amid rising slippages.

Return ratios dropped:

- RoA slipped to 1.47% (vs. 1.65%)

- RoE dipped to 13.14% (vs. 16.26%)

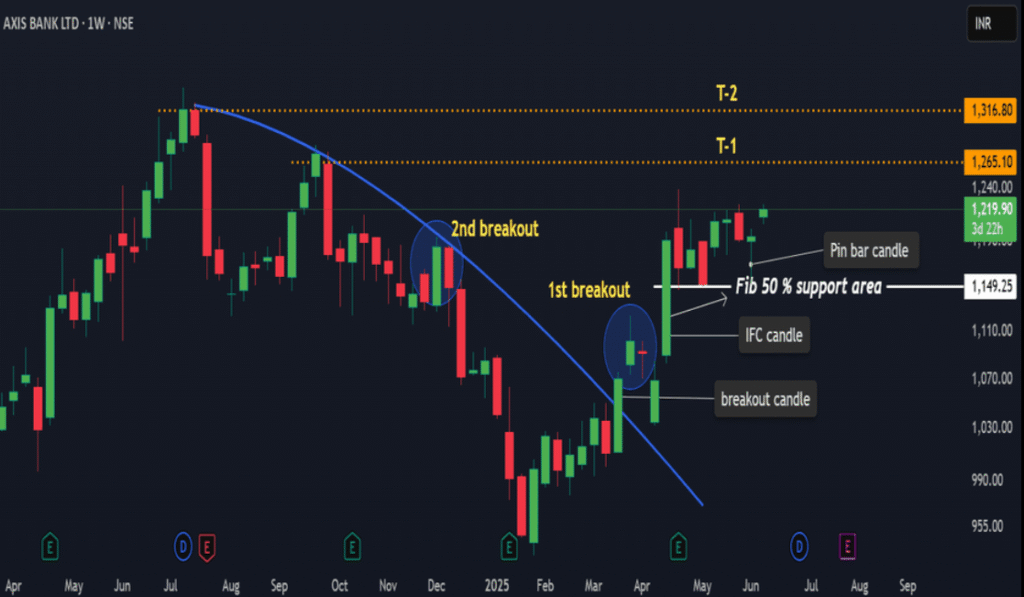

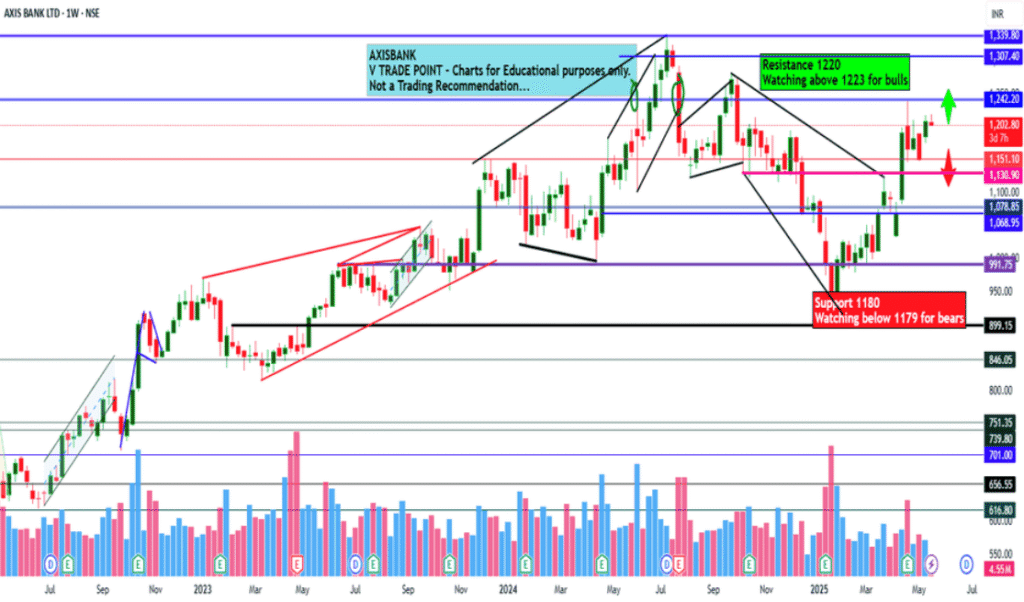

Share Price Technicals: Range-Bound But Weak Bias

| Technical Indicator | Signal |

|---|---|

| Support Level | ₹1,140 – ₹1,160 |

| Resistance Level | ₹1,200 – ₹1,250 |

| 20-Day EMA | Near ₹1,175 |

| RSI (14-Day) | Around 44–46 (Neutral) |

| Momentum | Weak – sideways channel |

The stock is consolidating near its 200-day EMA, and a break below ₹1,140 could trigger deeper correction toward ₹1,100–₹1,080 levels. Recovery past ₹1,200 could indicate reversal.

Axis Bank Valuation vs. Peers (As of July 2025)

| Metric | Axis Bank | HDFC Bank | ICICI Bank |

|---|---|---|---|

| Price-to-Earnings | 12.8x | 17.4x | 19.2x |

| Price-to-Book | 1.9x | 2.6x | 3.1x |

| RoE (%) | 13.1% | 17.6% | 18.3% |

| Net NPA (%) (est.) | ~0.36% | ~0.3% | ~0.45% |

Insight: Axis Bank remains attractively valued compared to peers but lags in profitability and return metrics post-Q1.

Expert Outlook: What Analysts Say

- Motilal Oswal: “Maintain BUY with a target of ₹1,450; expect profitability recovery in H2 FY26.”

- Prabhudas Lilladher: “Earnings miss is temporary; expect recovery by Q3. Upside target ₹1,500.”

- Nomura India: “Risk of elevated provisions remains. Prefer ICICI over Axis for now.”

Investment Advice: What Should Investors Do?

Long-Term Investors

- Advice: Hold; consider buying on dips below ₹1,140.

- Rationale: Core metrics are strong. Revenue and operating income growth provide visibility. Valuations are still attractive (~25% below intrinsic value), but clarity on slippages is needed.

Medium-Term Traders

- Advice: Watch support at ₹1,140 and resistance at ₹1,200.

- Rationale: Use a stop-loss strategy if buying in this zone. RSI is neutral. Wait for a breakout for trend confirmation.

Short-Term Speculators

- Advice: Avoid aggressive entry; volatility expected post-results.

- Rationale: Earnings miss and higher provisions may lead to choppy price action in coming weeks.

Final Thoughts

Axis Bank’s Q1 FY26 results are a reminder that earnings resilience and risk management go hand in hand. While revenue and fee income performance were commendable, the dip in profit and return ratios raises short-term caution. Long-term investors can stay invested, while short-term participants should wait for technical confirmation.

With asset growth intact and sector-wide improvement likely in H2 FY26, Axis Bank remains a core banking stock to watch—provided it reins in provisioning and revives margins.