Introduction: Urban vs Rural India Financial Behavior Compared

India’s financial story is not a single book; it’s a stacked library. Urban households and rural households often read different chapters. Understanding how and why people borrow, save, use digital wallets, or purchase insurance across these settings is crucial for developing better policies, designing smarter fintech products, and fostering more resilient livelihoods.

Urbanization shapes incentives, access, and habits. Cities bring banks, branches, apps, and jobs that pay salaries. Villages bring seasonality, crop risk, cash flows tied to harvests, and social norms that can be conservative about money. This article examines those differences, explains the underlying drivers, and suggests potential avenues for bridging the gap.

Understanding the Financial Landscape of India

1. Rural India: Agricultural economy and informal finance dependence

Rural India remains strongly linked to agriculture, seasonal incomes, and informal credit cycles. Household cash flow often spikes during harvest and shrinks before the next sale. This pattern encourages short-term borrowing (to buy seeds, fertilizer, or tide over lean months) and reliance on community credit, moneylenders, or pawn loans. While formal access has improved, many rural families still prefer or must use informal options because they’re fast, local, and culturally embedded.

NABARD’s All-India Rural Financial Inclusion Survey (NAFIS) documents important progress in rural access to finance (bank accounts, insurance, pensions), but it also highlights continuing reliance on credit and local financial arrangements.

2. Urban India: Service-driven economy and structured finance access

In urban areas, incomes are more regular (salaried jobs, formal wages) and financial ecosystems are denser. Banks, NBFCs, fintechs, and credit bureaus are within reach. This leads to more use of formal loans (home loans, personal loans, education finance), saving instruments (fixed deposits, mutual funds), and digital payments. Urban consumers are also exposed to a wider array of financial marketing, credit offers, and online comparison tools, behaviorally nudging them toward formal financial services.

3. The socio-economic divide as a financial behavior driver

The divide isn’t just geography; it’s infrastructure, literacy, trust, and social norms. A village with poor telecom signals and a town with 4G will have very different digital adoption curves. A family that inherits gold may prefer jewelry as a savings vehicle; a salaried urban family may prefer SIPs or bank FDs. Understanding those levers explains behavior more than geography alone.

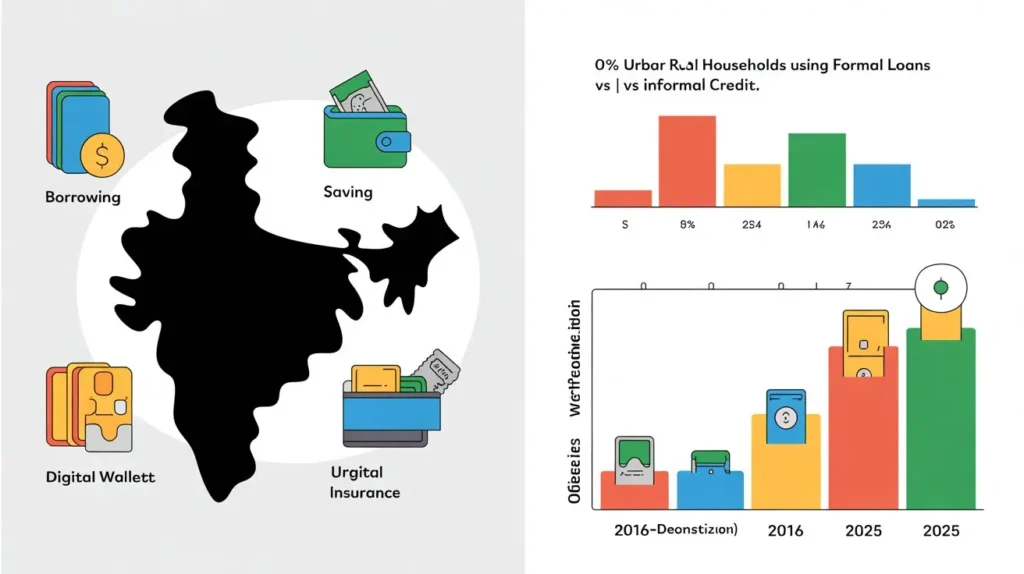

Borrowing Behavior Across Rural and Urban Households

1. Common reasons for borrowing in rural households (farming, healthcare, emergencies)

Rural borrowing is often cyclical and necessity-driven: seeds and inputs before harvest, emergency healthcare, weddings, or weather shocks. Loans tend to be smaller, shorter-term, and frequently repaid from the next sale. When harvests fail, the need to borrow rises rapidly. The same event that prompts the most debt is the one that reduces the capacity to repay.

2. Borrowing in urban households (housing, education, consumer durables)

Urban borrowing skews towards longer-term, higher-ticket items: housing loans, education loans, vehicle loans, and consumer durables purchased on EMI. Access to formal credit means urban borrowers often have better interest rates and documented repayment schedules; they also build credit histories that open more product variety.

3. Sources of loans: informal vs formal channels

- Rural: local moneylenders, input suppliers (credit through seed/fertilizer vendors), relatives, chit funds, and increasingly microfinance institutions (MFIs) or SHG-linked credit.

- Urban: commercial banks, NBFCs, fintech lenders (personal loans), credit cards, and peer-to-peer lending.

NABARD and other studies show steady expansion of formal credit in rural India, but note that informal sources persist because of immediacy and social ties.

4. Role of microfinance institutions in bridging the rural credit gap

MFIs and self-help group (SHG) programs have been pivotal in extending small-ticket credit to rural households, particularly women borrowers. The microfinance sector has seen significant growth and plays a key role in household risk management and entrepreneurship financing. However, recent sectoral stress and regulatory tightening have impacted lending volumes and appetite, signaling a need for careful risk management and sustainable business models.

5. Impact of credit culture and repayment patterns

Repayment culture differs: many rural borrowers prioritize community relationships and reputation, which can support high repayment rates in group-lending setups. Urban borrowers’ repayment behavior is more influenced by formal credit scoring, wage stability, and disposable income. Defaults in either setting can cause cascading effects, village-level credit stress, or banking NPAs in urban-lending portfolios.

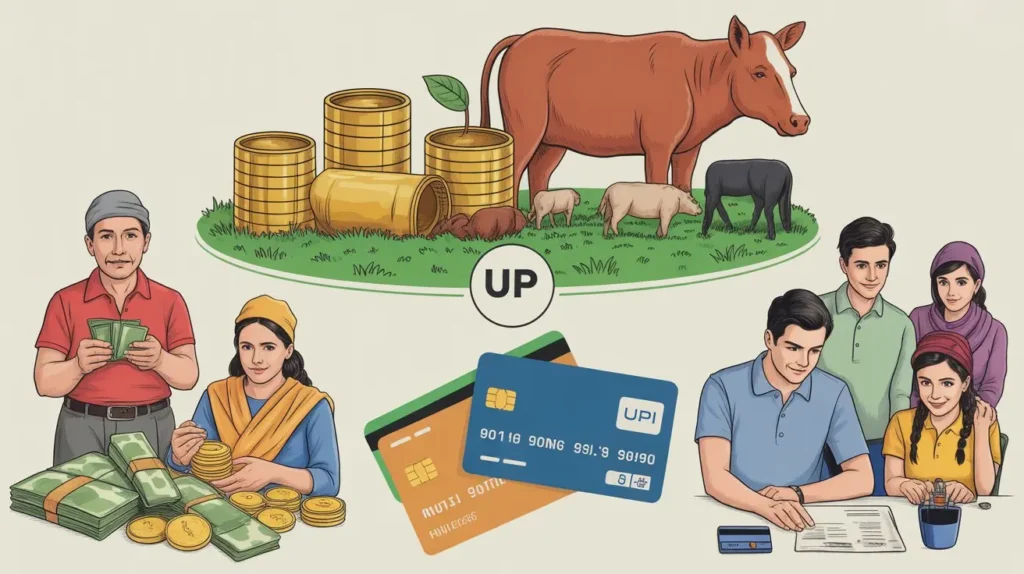

Saving Behavior: Contrasting Motives and Methods

1. Traditional saving habits in rural households (gold, livestock, cash at home)

Rural households commonly save in tangible assets: gold, livestock, land, or cash stored at home. These serve dual roles: a store of value and a social signal (gold at weddings). Tangibles are easily liquidated locally and serve as both savings and informal collateral.

2. Urban saving practices (bank deposits, mutual funds, SIPs)

Urban savers increasingly use formal instruments: bank savings accounts, fixed deposits, mutual funds (SIPs), PPF, and digital wallets for day-to-day money management. The regular salary cycle makes automated saving mechanisms (SIP deductions, standing instructions) attractive and easy to maintain.

3. Social and cultural drivers of savings preferences

Savings choices reflect trust and social norms. In communities where banks are distant or had past failures, physical assets dominate. Urban households exposed to financial advice, comparison engines, and apps are likelier to diversify into financial instruments. Risk appetite, intergenerational behavior (what parents did), and aspirations (education, housing) also shape choices.

4. Accessibility of financial institutions and its effect on saving patterns

Proximity to bank branches, mobile banking coverage, and digital literacy all influence whether people use formal savings accounts. Initiatives like PMJDY massively expanded account ownership in both rural and urban India, changing the baseline but account ownership alone doesn’t equal active saving in banks. PMJDY account penetration is large and growing; as of mid-August 2025, PMJDY accounts were reported in the tens of crores.

Digital Wallet Adoption and Cashless Economy

1. Rise of UPI and mobile wallets in urban India

UPI has transformed payments in India it’s fast, free (for many use cases), and widely accepted. Monthly UPI volumes crossed landmark levels in 2025, reflecting deep urban adoption and increasing use in semi-urban and rural commerce as well. The platform’s ubiquity makes it the default payment rail for many city-dwellers.

2. Barriers to digital adoption in rural areas (literacy, infrastructure, trust)

Rural adoption faces practical barriers: intermittent internet, lower smartphone ownership in some pockets, digital literacy gaps, and trust issues. Cash remains a fallback because it’s guaranteed, immediate, and anonymous. Where digital services are introduced without adequate training or reliable connectivity, uptake remains shallow.

3. Government initiatives driving financial digitalization

Programs under Digital India, incentives for mobile banking, and support for last-mile payment acceptance have accelerated digital payments. Government push + private fintech innovation created an ecosystem where UPI, Aadhaar-enabled payments, and merchant onboarding accelerated cashless adoption.

4. The pandemic as an accelerator for digital wallet usage

COVID-19 nudged many consumers and merchants to try contactless and digital payments. Urban users escalated usage immediately; rural adoption lagged but saw measurable increases as beneficiaries received subsidies and transfers directly into bank accounts, requiring digital rails.

5. Case studies: Paytm, PhonePe, Google Pay penetration in cities vs villages

Market leaders focused first on urban markets intense marketing, merchant partnerships, and cashback. As these players expanded agent networks and lowered onboarding friction, penetration increased in smaller towns and villages. Still, usage intensity (transactions per capita) remains higher in urban centers, even if coverage is expanding rapidly. Recent NPCI monthly statistics show UPI volumes climbing consistently through 2024–25, with monthly transactions surpassing 20 billion in August 2025 a marker of mainstream adoption.

Insurance Adoption and Risk Management Practices

1. Urban households: Health, life, and motor insurance trends

Urban households typically buy a broader mix of insurance products health plans (individual/family floater), life insurance tied to financial planning, motor insurance (mandated), and property insurance. Awareness and distribution channels (agents, online platforms, employee benefits) make it easier to purchase and renew policies.

2. Rural households: Awareness gaps and low penetration levels

Rural insurance penetration has improved but remains uneven. Product complexity, perceived value, and liquidity constraints reduce demand. Crop insurance (like PMFBY) focuses on agricultural risk, but uptake of life and health insurance among rural households still trails urban rates though NABARD’s surveys note rising awareness.

3. Role of government schemes like PMFBY and Ayushman Bharat

Targeted schemes have increased formal risk coverage: PMFBY for crop losses and Ayushman Bharat for health coverage among poor families. PMFBY enrolments and claims have grown significantly in recent years, expanding financial protection for farmers. Ayushman Bharat has expanded hospital coverage for vulnerable households, lowering out-of-pocket medical shocks. PMFBY administrative dashboards and government releases show large application and claim numbers reflecting this scale-up.

4. Cultural attitudes toward risk and financial protection

Many rural households view insurance as complex or unnecessary, preferring community support in times of crisis. Urban households, exposed to higher awareness and medical inflation, often view insurance as essential planning. Cultural norms, trust in institutions, and prior claim experiences heavily influence uptake.

5. How affordability and trust shape insurance choices

Affordability is a real constraint premiums matter. When claims are perceived as difficult to get, trust collapses. Simplified products, mobile-based enrolment, and prompt claim settlement build credibility and uptake.

IRDAI’s annual monitoring indicates national-level trends in penetration and density; these high-level metrics help policymakers gauge where to push product design and awareness campaigns.

Drivers of Differences in Financial Behavior

1. Income disparities and occupational structures

Irregular farm incomes vs regular salaries change borrowing needs and saving patterns. Urban jobs produce steady paychecks that make credit scoring easier and enable long-term financial planning. Rural livelihoods are more volatile and tied to commodity cycles.

2. Educational levels and financial literacy gaps

Education and financial literacy correlate with product adoption. NABARD’s NAFIS found measurable improvements in rural financial literacy but also highlighted gaps compared to urban benchmarks. Education matters for understanding long-term instruments (mutual funds, insurance) and for navigating digital platforms.

3. Infrastructure and technology accessibility

Internet and telecom coverage is a gating factor. TRAI’s yearly indicators show India’s massive broadband subscriber base but the quality and rural reach vary, affecting digital financial services adoption.

4. Gender roles in financial decision-making

Women in rural India are increasingly central to household financial decisions especially where SHG models are strong. Urban households may formalize joint financial management (bank accounts, investments). Gender norms influence who holds accounts, who transacts digitally, and who makes insurance choices.

5. Influence of social networks and peer behaviors

Network effects are powerful. If a trusted neighbor uses a digital wallet or buys a microinsurance product successfully, adoption in the community rises. Conversely, a negative rumor can stall uptake.

6. Urban exposure vs traditional practices

Exposure to marketing, peer behaviors, and urban lifestyle fuels aspiration-driven financial choices: mortgages for flats, consumer loans for electronics, or retirement planning. Traditional practices (gold, savings clubs) persist where trust in modern options is low.

The Role of Policy and Financial Inclusion Initiatives

1. Pradhan Mantri Jan Dhan Yojana and banking penetration

PMJDY dramatically expanded account ownership across India, reducing the “no-account” population and creating a channel for subsidies and direct benefit transfers. The scheme’s reach into both rural and urban areas established a baseline for formal financial participation. As of mid-August 2025, PMJDY reported over 56 crore accounts, reflecting the scale and role of the program in boosting access.

2. Aadhaar-linked services and direct benefit transfers

Aadhaar linkage enabled reliable ID verification, easing KYC for bank accounts and streamlining direct benefit transfers. This reduced leakage and made receiving government payments into bank accounts commonplace, indirectly encouraging account use.

3. Rural credit and subsidy schemes

Schemes and refinancing from NABARD, priority sector lending mandates, and targeted crop insurance subsidization have widened formal credit’s footprint. Yet, more work is needed to ensure credit is affordable and tailored to seasonal income patterns.

4. Impact of digital India and fintech startups

Digital India’s infrastructure push combined with nimble fintech offerings (UPI apps, BC networks, microinsurance via mobile) has accelerated inclusion. Fintechs have taken big risks on distribution, onboarding, and low-cost servicing making previously unbanked segments reachable at scale.

Future Outlook: Bridging the Urban-Rural Financial Divide

1. Emerging fintech solutions for rural markets

Agents, voice-enabled interfaces, regional-language apps, and offline payments are emerging as promising solutions. Business correspondents and fintech partnerships with cooperatives can deliver credit, savings, and insurance more effectively.

2. Leveraging mobile penetration for inclusive finance

With India’s enormous broadband and mobile base, mobile-first design (low-data, simple UI, vernacular support) can democratize access. TRAI and government data show broadband subscriber bases in the hundreds of millions an opportunity for scale if rural QoS and device affordability improve.

3. Role of education in changing financial behavior

Financial literacy campaigns tailored to local contexts using community leaders, SHGs, and local languages work better than one-size-fits-all programs. Teach the “why” (risk mitigation, compound interest) and the “how” (using an app, filing a claim).

4. Policy recommendations for sustainable financial inclusion

- Design seasonal credit products aligned to harvest cycles.

- Push simple, trust-building insurance (pay-out proof-of-concept projects, auto-claim triggers).

- Subsidize rural digital infrastructure and ensure minimum QoS.

- Promote women-led savings and credit groups for stronger household outcomes.

- Encourage partnerships between fintechs, banks, and local cooperatives for distribution and last-mile servicing.

Conclusion

Urban and rural India are part of the same economy but operate with distinct financial logics. Urban households benefit from steady incomes, dense financial ecosystems, and rapid digital adoption; rural households navigate seasonality, social credit, and risk tied to nature and markets. Policies and products that recognize those differences not treat all consumers as identical will close gaps faster.

Bridging the divide matters beyond fairness: it’s about macro resilience. When rural households have productive access to credit, savings, digital payments, and insurance, they invest more, withstand shocks better, and contribute to more stable growth. That’s good for villages, cities, and the nation.

Want to know how these financial patterns impact your daily life? Subscribe now for insights tailored to you!

FAQs

Q1. Why do rural households still rely heavily on informal credit?

Informal credit is local, fast, and often requires little paperwork. It fits seasonal cycles (short-term loans before harvest) and social ties provide flexible repayment arrangements. Formal credit has expanded, but accessibility, speed, and relationship factors keep many rural borrowers tied to informal sources.

Q2. What are the biggest barriers to digital wallet adoption in villages?

Main barriers: inconsistent internet/telecom quality, lower smartphone penetration in some pockets, digital literacy gaps, and trust concerns. When merchants or neighbors don’t accept digital payments, cash remains the default. Infrastructure + training + trust-building are required to close that gap.

Q3. How does gender influence financial decision-making in rural India?

Women are increasingly active in financial decisions, particularly where SHGs and microfinance linkages exist. Female financial agency often improves household savings and investment decisions; however, gender norms and access constraints (phone ownership, mobility) still shape who transacts and who controls larger financial decisions.

Q4. Are government insurance schemes making a real difference in rural areas?

Yes, targeted schemes like PMFBY and Ayushman Bharat have materially increased coverage for agricultural and health risks, respectively, reducing immediate out-of-pocket shocks. Uptake varies by state and awareness, and effective claim settlement is key to building trust. PMFBY administrative dashboards report large enrolment and claim numbers in recent years.

Q5. What steps can fintech companies take to better serve rural India?

Design low-data, vernacular apps; build agent networks for onboarding and education; partner with cooperatives and SHGs; offer seasonal or flexible credit products; and create simple insurance with quick, understandable pay-outs. Trust and local presence trump product novelty.

Q6. How is financial literacy evolving across urban and rural India?

Financial literacy is improving NAFIS shows measurable gains in rural awareness but gaps remain. Urban populations generally score higher on instruments and product knowledge, while rural gains are often driven by targeted programs, SHGs, and scheme-linked onboarding.

Q7. Can digital payments replace cash entirely in rural India?

Unlikely in the near term. Cash serves as an important liquidity cushion and culturally accepted medium. Digital payments will continue to grow rapidly, but meaningful substitution requires reliable connectivity, merchant acceptance, and trust plus products that match rural cash-flow rhythms.