I. Introduction

The Goods and Services Tax (GST), introduced in India in July 2017, replaced a complex web of indirect taxes with a unified system. While GST simplified taxation, issues like compliance burdens, multiple tax slabs, input credit mismatches, and revenue shortfalls persisted.

Enter GST 2.0, an upgraded framework that promises to address these inefficiencies. Often referred to as the “second generation GST,” it focuses on simplification, technology-driven compliance, and a fairer distribution of revenue.

This article explores the impact of GST 2.0 across businesses, consumers, and the government, highlights the challenges and opportunities it brings, and provides policy recommendations for smooth implementation.

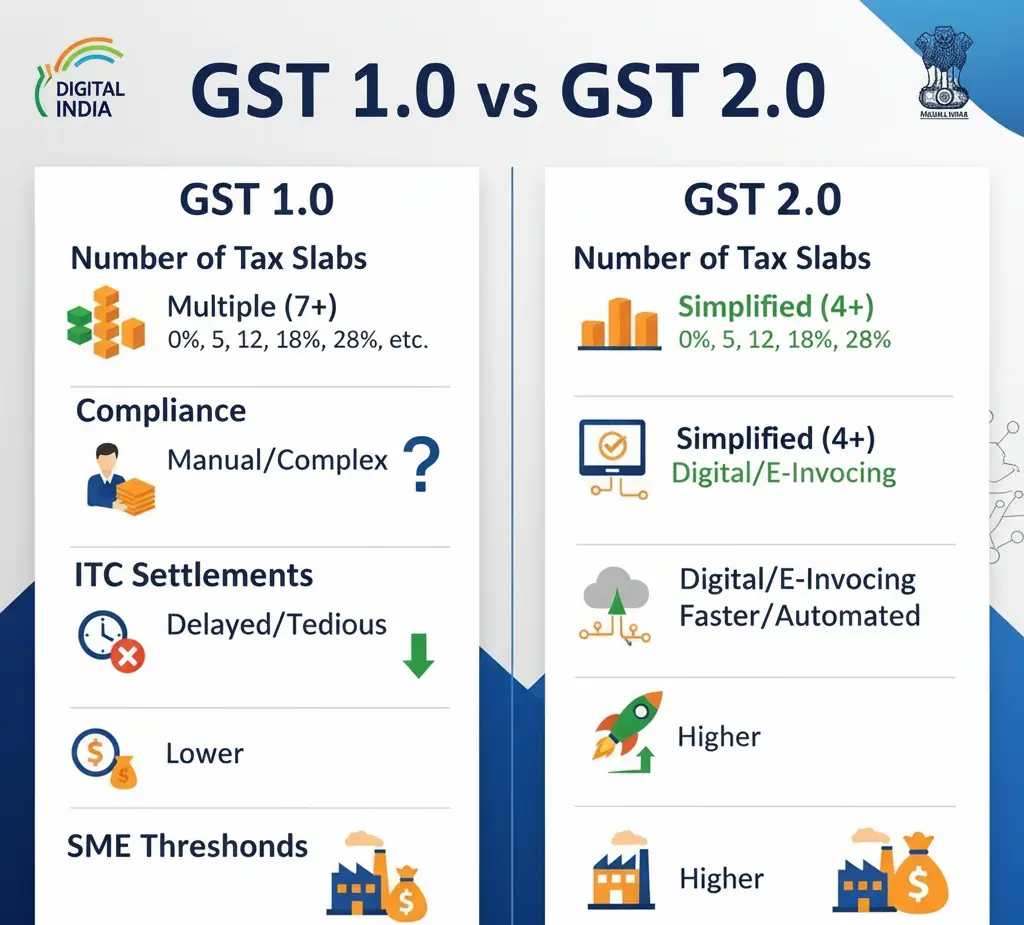

II. What Is GST 2.0: Key Changes vs GST 1.0

GST 2.0 changes are designed to fix structural gaps in the current regime. Key highlights include:

- Rationalization of tax slabs: Possible reduction from four major slabs to three, for simplicity.

- Revised input tax credit (ITC) rules: Stricter verification to curb fraud, faster settlements for genuine businesses.

- E-invoicing & automation: Wider adoption of AI-driven compliance platforms, reducing manual intervention.

- Threshold revisions: Higher exemption limits for small businesses to ease compliance burden.

- Simplified returns: Merging multiple monthly/quarterly returns into a single, consolidated filing system.

- Reverse charge mechanism reforms: Narrower scope, reducing compliance issues for small players.

- Phased rollout: Implementation in stages, starting with large enterprises before expanding to SMEs.

III. Government Objectives & Rationale

The government’s rationale behind GST 2.0 in India includes:

- Boosting revenue mobilization by reducing tax leakages.

- Improving ease of doing business, especially for SMEs.

- Enhancing transparency with digital-first processes.

- Simplifying compliance to reduce litigation.

- Strengthening federalism, ensuring fair revenue distribution between states and the center.

Reports from economic think tanks like NIPFP and NITI Aayog have long suggested reforms to make GST more efficient, which shaped GST 2.0’s blueprint.

IV. Impact on Businesses

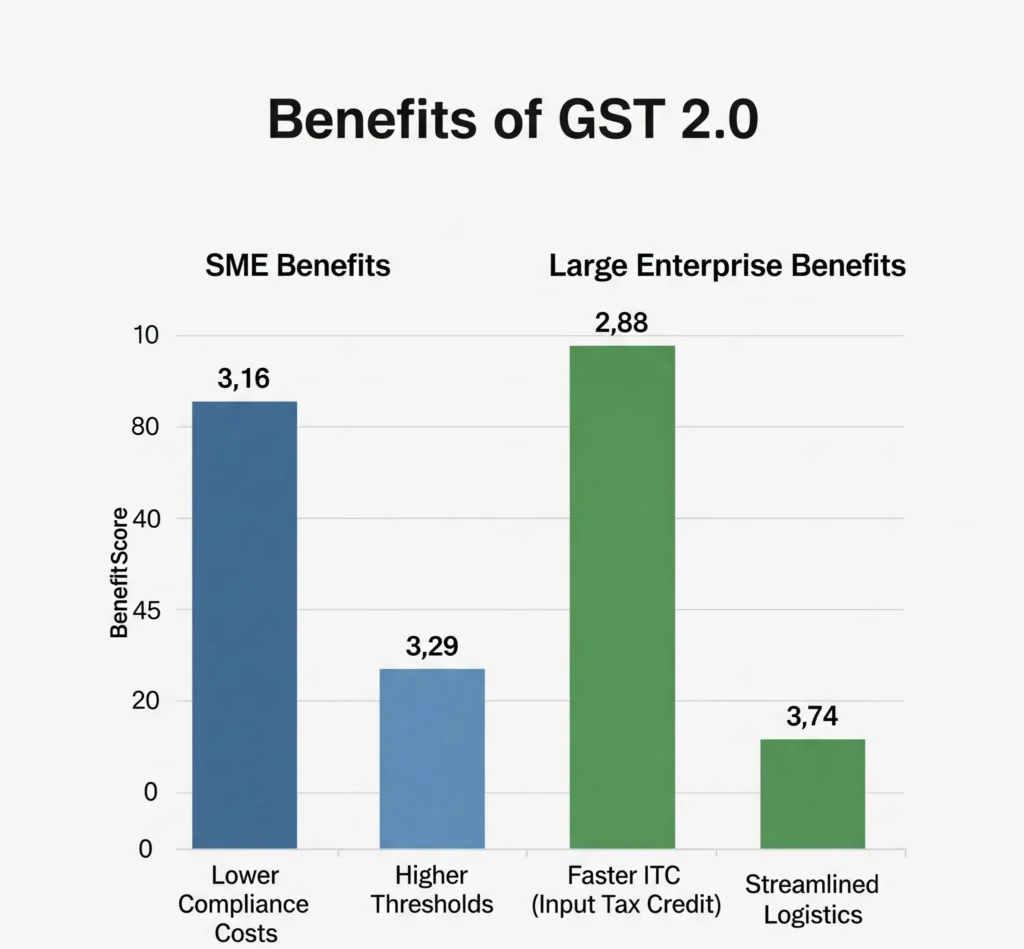

Small & Medium Enterprises (SMEs)

- Reduced compliance load via higher exemption thresholds.

- Lower IT costs with simplified filings.

- Short-term challenges in upgrading to new digital systems.

Large Enterprises

- Improved cash flow with faster ITC settlements.

- Adjustments required in ERP and accounting systems.

- Enhanced supply chain efficiency due to slab rationalization.

Sectoral Impacts

- Manufacturing: More predictable tax credits, lower cascading.

- Services: Easier compliance for pan-India service providers.

- E-commerce: Clearer rules on place-of-supply and GST on online marketplaces.

- Agriculture: Potential relief on farm equipment and supply-chain taxation.

Cross-Border Trade

- Better export competitiveness due to faster refunds.

- Simplified import duties align with global practices.

V. Impact on Consumers

- Pricing shifts: Goods in higher slabs may get cheaper, but some services could see higher taxation.

- Short-term inflation: Transition may trigger temporary price hikes.

- Transparency: Consumers benefit from clearer invoices and fewer hidden costs.

- Behavioral changes: More consumption of items placed in lower slabs.

VI. Impact on Government & Revenue

- Revenue growth: Curbing evasion through tech-enabled monitoring.

- Lower leakage: Stronger ITC reconciliation reduces fraud.

- Fiscal stability: Greater predictability in tax collection helps budget planning.

- Administrative gains: Lower litigation costs and streamlined audits.

VII. Implementation Challenges & Risks

Despite its benefits, GST 2.0 implementation faces hurdles:

- Tech infrastructure: Ensuring GSTN (Goods & Services Tax Network) handles increased load.

- Awareness gaps: SMEs in rural areas may struggle with digital compliance.

- Transition issues: Old contracts and inventory may create disputes.

- State-level disparities: Resistance from states fearing revenue loss.

- Regressive risk: If poorly designed, GST 2.0 could disproportionately affect low-income households.

Major Product / Category Changes under GST 2.0

| Product / Category | Old GST Rate or Slab | New Rate / Change under GST 2.0 | Notes / Details |

|---|---|---|---|

| Food & Daily Essentials | |||

| UHT milk, paneer (pre-packaged), pizza bread, khakhra, chapati, roti | 5% or 12% | Nil (0%) for many staple bread items, etc. | |

| Butter, ghee, cheese, dairy spreads | 12% | 5% | |

| Dry fruits, nuts, dates | 12% (some 18%) | 5% | |

| Namkeens, mixtures, packaged snacks (bhujia etc.) | 18% | 5% | |

| Pre-packaged foods: pasta, biscuits, jam, jelly, sauces | 12-18% | 5% | |

| Household & Personal Care | |||

| Shampoo, hair oil, toilet soap bars, face powder | 18% | 5% | |

| Toothpaste, toothbrush, dental floss | 18% | 5% | |

| Namkeens, mixtures, packaged snacks (bhujia, etc.) | 12% | 5% | |

| Umbrellas & Accessories | 12% | 5% | |

| Education & Stationery | |||

| Maps, charts, globes; printed educational charts | 12% | Nil (0%) | |

| Pencils, sharpeners, crayons, pastels, laboratory notebooks, exercise books, graph books | 12% | 0% / Nil in many cases | |

| Healthcare & Related | |||

| Life-saving medicines / essential drugs | 12% | 5% or sometimes nil for many items | |

| Utensils, tableware/kitchenware | 12% | 5% | |

| Corrective spectacles, goggles | 28% | 5% | |

| Agriculture & Farming Inputs / Machinery | |||

| Medical devices: diagnostic kits, reagents, glucometers, test strips | 12-18% | 5% | |

| Tractors and certain tractor parts / auto-parts used in agriculture (tyres, tubes, etc.) | 12% | 5% | |

| Fertilisers, bio-pesticides, micro-nutrients | 12% | 5% | |

| Consumer Durables / Electronics | |||

| Televisions (LED, LCD, monitors, projectors) | 28% | 18% | |

| Air conditioners, dishwashers | 28% | 18% | |

| Auto / Vehicles | |||

| Small cars (petrol/LPG/CNG ≤ 1200cc; diesel ≤ 1500cc) | 28% | 18% | |

| Motorcycles up to 350cc | 28% | Drip irrigation, sprinklers, harvesters, and agricultural machinery | |

| Moved to a 40% “sin/luxury” slab for many higher-value / capacity vehicles, etc. | 28% (or higher burden earlier) | Moved to a 40% “sin/luxury” slab for many higher-value / capacity vehicles, etc. | |

| Bicycles and parts | 12% | 5% | |

| Housing / Construction / Building Materials | |||

| Cement | 28% | 18% | |

| Tiles, marble, granite, stone inlay, wood works | 12% | 5% | |

| Bamboo flooring, packing cases & pallets (wood) | 12% | 5% | |

| Luxury / Sin / Premium Goods | |||

| Aerated beverages, carbonated drinks, caffeinated drinks (non-basic) | Larger bikes / premium vehicles / SUVs, etc. | Previously taxed but with compensation cess, etc. | |

| Motorcycles above 350cc; premium cars, large capacity vehicles | Moved to a higher slab 40% in 40% of cases |

- Pan masala, cigarettes, etc. Scheduled under 40% (sin goods), though some delay/deferment in implementation for certain items.

- Furniture, handicrafts, and general household decor items are moving to 5% from older, higher slabs.

- Sugar products, boiled sweets, jam/jelly/marmalade, etc., moving from 12-18% to 5%.

- Vegetable extracts, thickeners, starches, and certain food additives are now at a lower rate.

- Tables, general home appliances & kitchenware (wood/metal/plastic) to 5%.

VIII. Opportunities & Positive Outcomes

- Greater formalization of the economy.

- Ease of doing business rankings improve, attracting FDI.

- Digital transformation accelerates, fostering fintech and compliance tools.

- Policy innovation with better real-time data on consumption and supply chains.

IX. Comparative Perspectives

Globally, countries like Australia and Malaysia have reformed their GST/VAT regimes to plug revenue gaps and simplify compliance. India’s GST 2.0 learns from these models, particularly in automation and consumer protection.

X. Policy Recommendations

To ensure a smooth rollout, the government should:

- Provide clear transition guidelines with a grace period.

- Offer training and awareness programs for SMEs.

- Introduce support measures for vulnerable consumers, like targeted subsidies.

- Adopt a phased rollout, starting with large businesses.

- Create an effective grievance redressal system.

XI. Future Outlook

Over the next 5–10 years, GST 2.0 India could:

- Reduce the number of slabs further.

- Integrate with the Direct Tax Code reforms for a holistic tax policy.

- Enable real-time tax analytics for better policymaking.

- Pave the way toward a “GST 3.0,” a fully AI-driven, near-frictionless system.

XII. Conclusion

GST 2.0 represents a decisive step toward a more efficient, transparent, and equitable tax regime in India. While businesses and consumers will face transitional pains, the long-term benefits of streamlined compliance, stronger revenue systems, and improved ease of doing business outweigh the challenges.

The real test lies in implementation: if the government ensures inclusivity, fairness, and digital readiness, GST 2.0 can truly transform India’s taxation landscape.

FAQs on GST 2.0

1. What is GST 2.0?

GST 2.0 is the next-generation Goods and Services Tax in India, aimed at simplifying compliance, rationalizing tax slabs, improving technology-driven reporting, and reducing revenue leakages compared to the current GST system.

2. How does GST 2.0 differ from GST 1.0?

Key differences include simplified tax slabs, revised input tax credit rules, e-invoicing for more businesses, consolidated returns, and phased implementation to ease transition for enterprises.

3. Who will benefit from GST 2.0?

1. Businesses: Reduced compliance burden for SMEs, faster input credit for large enterprises.

2. Consumers: More transparent pricing, potential reduction in cascading taxes.

3. Government: Higher revenue collection and reduced tax evasion.

4. What challenges might GST 2.0 face?

Implementation risks include technological readiness, training gaps for SMEs, transitional issues with old stock or contracts, and disparities among states or regions.

5. How will GST 2.0 affect consumer prices?

Some goods and services may become cheaper due to rationalized slabs, while others could see minor increases. Overall, transparency and reduced hidden taxes are expected to benefit consumers.

6. When will GST 2.0 be implemented in India?

Implementation is expected in phases, starting with large enterprises and high-compliance sectors, followed by SMEs and other stakeholders. Exact timelines depend on government notifications and pilot programs.

7. How does GST 2.0 impact businesses?

Businesses will experience easier compliance, streamlined return filing, better cash flow due to faster ITC settlements, and digital integration for supply chain and taxation processes.

8. What are the government’s objectives with GST 2.0?

The objectives include improving revenue collection, reducing evasion, simplifying the tax system, encouraging digitization, and enhancing ease of doing business in India.

9. Will GST 2.0 affect exports and imports?

Yes. GST 2.0 aims to make exports more competitive through faster refunds and to streamline cross-border taxation to align with international best practices.

10. Where can I find official updates on GST 2.0?

Official updates are published by the Government of India, the GST Council notifications, and economic think tanks like NITI Aayog or NIPFP.