Bajaj Finance Share 2025: A Comprehensive Guide for Investors

Bajaj Finance Ltd., one of India’s top-performing non-banking financial companies (NBFCs), has emerged as a cornerstone of retail and SME credit in India. Known for its innovative digital ecosystem and consistent financial growth, it has become a popular investment option for long-term investors. In this article, we will analyze Bajaj Finance’s stock performance, financials, shareholding, peer comparisons, and most importantly—its 5-year future outlook to determine whether it’s still a good buy in 2025 and beyond.

1. Company Overview

Founded: 1987

Headquarters: Pune, Maharashtra

Parent Organization: Bajaj Finserv Ltd.

CEO & MD: Sanjiv Bajaj

Core Business Segments: Consumer durable finance, SME loans, gold loans, rural lending, deposits, insurance, and digital lending.

The company’s strong focus on digital transformation and technology-backed financial services has positioned it as a formidable fintech-NBFC hybrid.

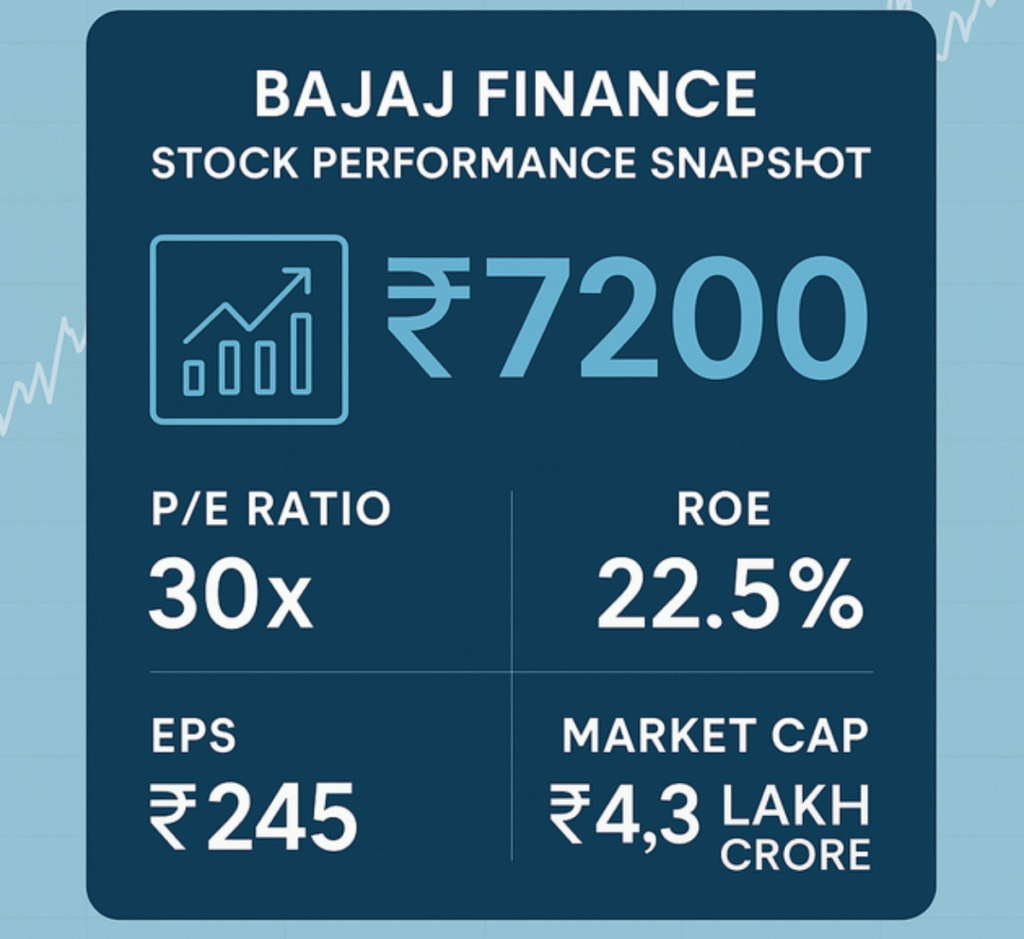

2. Bajaj Finance Share Price Performance Snapshot (as of July 2025)

| Metric | Value |

|---|---|

| Current Share Price | ₹7,200 |

| 52-Week High / Low | ₹7,560 / ₹5,480 |

| Market Capitalization | ₹4.3 Lakh Crore |

| Price-to-Earnings (P/E) | ~30x |

| Dividend Yield | 0.38% |

| Return on Equity (RoE) | 22.5% |

| Earnings per Share | ₹245 (TTM) |

Bajaj Finance’s share price has shown resilience and steady growth, even amid broader market volatility.

3. Financial Performance: FY24 vs FY25

4. Strategic Growth Drivers

Digital-First Expansion: 75%+ loans sourced digitally

EMI Cards: Over 4 crore users

Buy Now Pay Later (BNPL): Growing rapidly through e-commerce partnerships

Geographic Reach: Deep penetration into Tier 3 and 4 cities

Customer Base: Over 8.3 crore active users

5. Shareholding Pattern (as of June 2025)

6. SWOT Analysis

Strengths:

Strong digital ecosystem

High-quality, diversified loan book

Low NPA and strong RoE

Brand trust and scalability

Weaknesses:

High valuations

Sensitive to regulatory and interest rate changes

Opportunities:

Rural lending and financial inclusion

Expansion in wealth management and insurance

Threats:

Fintech competition

Macroeconomic volatility

7. Future Insight: 5-Year Growth Forecast (2025–2030)

| Year | Expected Revenue | Net Profit (Est.) | EPS Target | Share Price Estimate |

| FY26 | ₹56,000 Cr | ₹14,500 Cr | ₹280 | ₹8,200 – ₹8,500 |

| FY27 | ₹64,000 Cr | ₹16,200 Cr | ₹310 | ₹9,000 – ₹9,400 |

| FY30 | ₹90,000+ Cr | ₹23,000+ Cr | ₹420+ | ₹11,000 – ₹12,000 |

Projections are based on a conservative CAGR of 14–16%, historical valuation trends, and industry growth.

Will It Gain or Lose?

Gain Factors:

Consistent revenue and AUM growth

Digital dominance

Favorable demographics and credit penetration in India

Possible Risk Factors:

Global recession

RBI regulations tightening

High interest rate cycle

Despite these risks, Bajaj Finance has a strong foundation and is projected to offer 40–60% growth in stock price over 5 years.

8. Peer Comparison: 2025 Snapshot

| Company | P/E Ratio | RoE | AUM | Gross NPA | Market Cap |

| Bajaj Finance | 30x | 22.5% | ₹3.08 L Cr | 1.14% | ₹4.3 L Cr |

| HDFC Ltd | 28x | 18.9% | ₹6.1 L Cr | 1.2% | ₹6.9 L Cr |

| Muthoot Finance | 18x | 16.5% | ₹0.8 L Cr | 1.6% | ₹0.6 L Cr |

| SBI Cards | 36x | 15.1% | ₹0.9 L Cr | 2.1% | ₹1.1 L Cr |

Bajaj Finance holds its edge in digital infrastructure and customer penetration.

9. Investment Strategy

Investment Horizon: Ideal for 3–10 year investors

Minimum Capital Required: ₹7,200 for 1 share. Investors can also use SIP or fraction investing methods for small monthly contributions.

Ways to Invest:

Via Demat account through brokers like Zerodha, Upstox, Groww, etc.

Direct Mutual Fund SIPs with exposure to Bajaj Finance

Investor Tip: Invest in market dips and avoid chasing rallies.

Profit Calculator Example:

Investment Today: ₹72,000 (10 shares)

Expected Value in 5 Years: ₹1,10,000 – ₹1,20,000

Return: 52% – 66%

Conclusion

Bajaj Finance is not just a stock—it’s a long-term value play for serious investors. With its strong fundamentals, growth-oriented digital strategy, and proven management, the stock is expected to outperform its peers over the next 5 years. If you’re planning for wealth creation with calculated risk, this stock deserves a core place in your portfolio.