An Earnings Shock That Rattled Shareholders

Bandhan Bank stunned investors in early July 2025 as Q1 FY26 results exposed a massive 65% year-over-year decline in net profit, slipping from ₹1,063 crore in Q1 FY25 to just ₹372 crore. The corporate banking world paused for breath as the bank flagged mounting stress in its microfinance portfolio—raising concerns about risk management, asset quality, and strategic adaptation. This article dives into the why, the numbers behind the slump, market reactions, and what this means for shareholders and prospective investors.

Financial Highlights: Breaking Down the Key Numbers

- Net Profit: ₹372 crore in Q1 FY26 vs ₹1,063 crore in Q1 FY25 — a steep 65% decline

- Net Interest Income (NII): ₹2,757 crore vs ₹2,987 crore YoY — down ~8%

- Total Income: ₹6,201 crore (+1.9% YoY)

- Operating Profit: ₹1,668 crore, down from ₹1,941 crore YoY

- Provisions & contingencies: ₹1,147 crore vs ₹523 crore — up 119%

- Gross NPA: 4.96% vs 4.23% YoY;

- Net NPA: 1.36% vs 1.15% YoY

- PCR (incl. write-offs): 87.3%; standalone PCR ~73.7%

- CASA ratio: ~27%

- Deposit base: ₹1.5 lakh crore (+16% YoY), total advances: ₹1.3 lakh crore (+YoY)

What Went Wrong: Microfinance Portfolio Under Strain

Asset Quality Deteriorates

The primary culprit: microfinance book under heightened stress. Fresh slippages totaled ~₹1,553 crore in Q1, with ₹1,080 crore emerging from the microfinance segment (Emerging Entrepreneurs Business unit) alone. This crisis catapulted provisions to ₹1,147 crore.

Guardrails & Growth Limitations

Bandhan Bank’s management highlighted regulatory guardrails limiting loan growth in safer fashion. This exacerbated margin pressure and asset quality woes—a tradeoff between growth and prudence.

Margin Pressure and NII Drop

Share Price Reaction & Market Sentiment

Immediate Reaction

Shares dropped sharply following the earnings release, reflecting heightened investor concern over future credit costs and continuing microfinance stress.

Sector Dynamics

Despite broader market support for NBFCs and microfinance lenders after RBI eased capital norms earlier in 2025, Bandhan slumped due to idiosyncratic asset quality weakness.

Investor Concern

Investor forums highlight concerns like legacy governance, leadership transitions with founder retirement, microfinance vulnerability, and high valuation risks—emphasizing potential multiple compression amid weak EPS growth.

Trailing Comparison: Where the Bank Stood Pre-Crisis

In Q1 FY25 (June 2024), Bandhan had posted strong numbers:

- Net profit jumped 47.5% to ₹1,063 crore

- NII rose 21% to ₹3,005 crore

- Operating profit soared 24% to ₹1,941 crore

- Provisions declined YoY, improving asset performance

- GNPA improved to ~4.23%; Net NPA to 1.15%

- PCR improved; deposits +23%, advances +22% YoY

This sharp reversal highlights the severity of Q1 FY26’s stress.

Mortality: Understanding Operational Levers & Market Outlook

CEO & Governance Transition

With founder Chandra Shekhar Ghosh retired in mid-2024, leadership rests with Partha Pratim Sengupta and interim executive teams. Lack of long-term CEO clarity creates uncertainty around strategic direction.

Financial Inclusion vs Prudence

Bandhan was built on microfinance; but the sector’s cyclicality now forces growth-limiting guardrails. Rebalancing toward lower-risk retail banking and secured credit may be essential to rebuild resilience.

Valuation Risk & EPS Credibility

Trading at premium valuations historically, the sharp fall in profit risks PE contraction. Without reliable EPS growth, elevated multiples may not sustain. Investors on forums flag this as a core risk to long-term returns.

Roadmap Ahead: What to Watch

Q2 FY26 and Beyond

Watch upcoming quarters (especially Q2 & Q3 FY26) for:

Stabilization in microfinance slippages

Provision trends

Recovering margins or slowing credit costs

Management notes recovery may begin in Q3 FY26 if slippages moderate and macro conditions stabilize.

Policy Shifts

Investment Strategy: Buy, Hold or Exit?

Long-term Investors

Thesis: The bank’s core microfinance franchise remains significant—if losses are one-off and credit portfolio stabilizes.

Strategy: Accumulate cautiously, averaging in phases post any drop near interim support levels and watching improvements in asset quality.

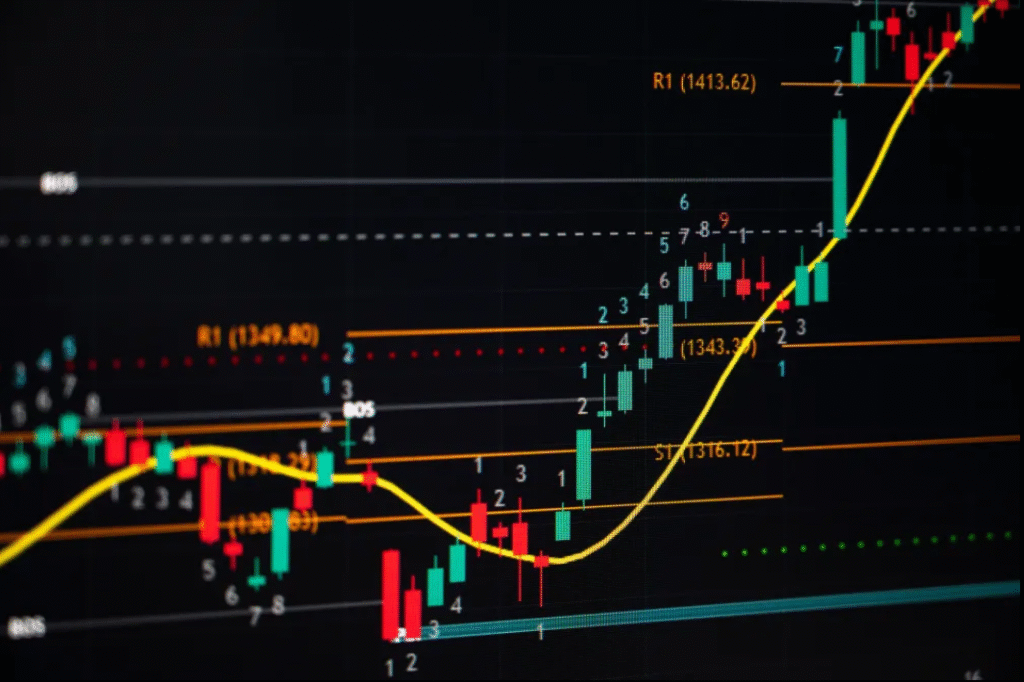

Medium-Term Traders

Thesis: High volatility, rapid sentiment swings—suitable for tactical trading.

Strategy: Trade on technical setups with strict stop-losses. Exit near key resistance levels; monitor news flow closely.

Conservative or Dividend Seekers

Thesis: High credit risk and earnings volatility make Bandhan unsuitable for income-focused portfolios.

Strategy: Avoid new exposure until asset quality stabilizes. Prefer regional or mid-cap banks with robust corporate credit profiles.

Summary Table: Q1 FY26 vs Q1 FY25 Metrics

| Metric | Q1 FY26 | Q1 FY25 | Change |

|---|---|---|---|

| Net Profit | ₹372 crore | ₹1,063 crore | ▼ 65% |

| NII | ₹2,757 crore | ₹2,987 crore | ▼ 8% |

| Operating Profit | ₹1,668 crore | ₹1,941 crore | ▼ 14% |

| Provisions | ₹1,147 crore | ₹523 crore | ▲ 119% |

| GNPA / Net NPA (%) | 4.96% / 1.36% | 4.23% / 1.15% | Asset quality deterioration |

| PCR (incl. write-offs) | 87.3% | ~71–74% | Improvement |

| Deposits / Advances | ₹1.5 / ₹1.3 lakh Cr | YoY growth 16–23% | Stable growth maintained |

| CASA Ratio | 27% | — | Moderate mix |

Final Thoughts

Bandhan Bank’s 65% profit drop in Q1 FY26 is a major red flag for investors, driven principally by microfinance portfolio stress and sharply elevated provisions. Despite healthy business growth and strong deposit momentum, recurring vulnerabilities and governance uncertainty weigh heavily on sentiment.

For growth-oriented investors, the risk-return profile may still offer opportunity—provided asset quality stabilizes and the bank demonstrates stronger risk discipline. For cautious, dividend-focused investors, waiting for clearer turnaround signals may be prudent.

Reddit Investor Voices

“Bandhan bank has not been able to justify the valuations with EPS growth… the PE compression is happening and because the EPS is also not growing, you have a double engine of wealth destruction.”

“The stock lost confidence of investors from covid when most of its customers couldn’t pay back and collection efficiency went for a toss… it will take some time.”