China-India Strategic Supply Reassurance: Rare Earths, Fertilizer & Tunnel Machines

In a pivotal diplomatic and trade development on August 19, 2025, China formally assures India that it will address urgent concerns over three critical sectors: rare earth minerals, specialty fertilizers, and tunnel boring machines. These assurances come in the wake of recently lifted export curbs, marking an important pivot in bilateral trade dynamics that could ease supply chain stress affecting India’s infrastructure and agricultural growth.

Background: The Supply Crunch & Geopolitical Context

Rare Earth Magnets

China, as the world’s predominant supplier of rare earth elements and magnets, has imposed export restrictions, particularly on rare earth magnets, impacting India’s industries ranging from electric vehicles to renewable energy and defense hardware.

Specialty Fertilizers

Since June 2025 and earlier, China effectively halted exports of specialty fertilizers encompassing water-soluble, micronutrient, nano, bio-stimulant, slow-release, and controlled-release variants by withholding routine CIQ (Entry-Exit Inspection & Quarantine) certifications. This caused a near-complete stoppage despite no official ban.

Dependence was acute

India typically imports 80% of its specialty fertilizer needs, roughly 150,000–160,000 tonnes between June and December. The refusal to supply had feared repercussions for kharif sowing, with farmers reporting steep price surges and shortages of DAP (Diammonium Phosphate) essentials.

Tunnel Boring Machines (TBMs)

Critically, TBMs meant for India’s flagship Mumbai-Ahmedabad bullet train, manufactured in China by Herrenknecht, were stuck, with export clearance delayed or denied despite being paid for.

Strategic Context

Behind these supply disruptions lay geopolitical undertones. India’s Press Note 3 (PN3), imposed post-Galwan border clashes, restricted Chinese FDI and investments, prompting Beijing to exercise trade leverage via non-tariff barriers

The Turning Point: China Lifts Curbs & Offers Assurances

On August 19, 2025, in a surprising yet welcome shift:

- China lifted export curbs on rare earth minerals, fertilizers, and tunnel boring machines destined for India.

- Diplomatic messages emphasized China’s commitment to resume these critical supplies, aimed at reinforcing industrial and agricultural cooperation.

This marks a thaw in overt trade tensions coupled with a renewal of pragmatic supply engagement.

Implications for India: Mitigating Risks & Seizing Commitment

Agriculture Stability

Resumption of fertilizer exports, if implemented promptly, should reassure farmers ahead of upcoming crop cycles, especially for horticultural sectors reliant on high-value inputs.

Infrastructure Continuity

Release of TBMs ensures smooth progress on the Mumbai–Ahmedabad bullet train project, a high-profile symbol of India’s modernization drive.

Manufacturing & Tech Sector Relief

Supply of rare earths removes an immediate bottleneck in India’s high-tech, renewable energy, and EV manufacturing pipelines.

At the same time, this move casts a spotlight on India’s strategic vulnerabilities and highlights the continuous need for diversified supply chains and localized investments.

India’s Strategic Response: Diversification & Self-Reliance

While the assurances are timely, experts stress that India needs a broader structural response:

Supply Diversification

- Fertilizers → Exploring alternative suppliers: Jordan, Russia, Saudi Arabia, Morocco, and encouraging domestic manufacturing by companies such as Deepak Fertilizers, Paradeep, Nagarjuna.

- Rare Earths → Deepening partnerships with Australia, USA, Japan, and promoting domestic exploration under the proposed India Rare Earth Mission.

- TBMs & Machinery → Seeking alternatives from German, Japanese, or Indian manufacturing firms.

Production-Linked Incentives (PLI) & Domestic Capacity Building

PLI schemes could catalyze the manufacturing of critical components and fertilizers, alongside encouraging green/nano-fertilizer innovation to reduce import dependency

Regulatory Reforms

Ease licensing burdens on Indian manufacturers, modernize testing frameworks, and align domestic standards to boost competitiveness against foreign imports

Diplomatic Balance: Navigating Engagement with Prudence

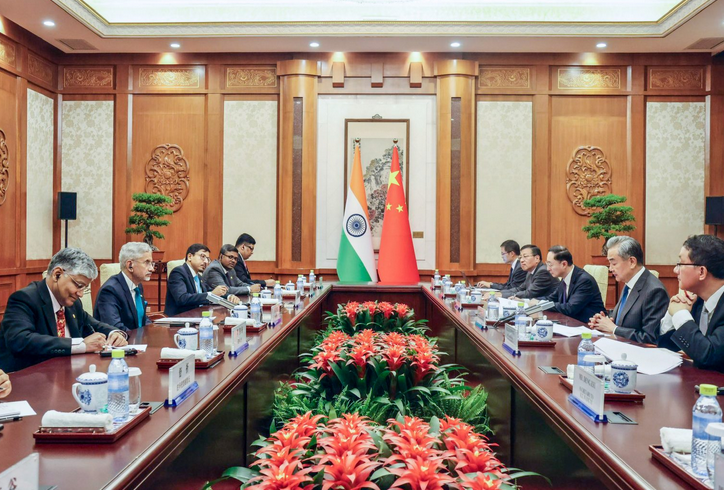

Despite strategic friction, diplomatic dialogue continues:

- India and China simultaneously pursued reassurance and refrained from provocations, evident in the resumed Kailash-Manasarovar Yatra and high-level visits.

- Beijing’s dual strategy of public outreach coupled with remnant trade pressure underscores India’s need to remain cautious and opportunistic.

Outlook: What Lies Ahead?

- Short-Term: Immediate export resumption should stabilize supply pipelines subject to Chinese procedural compliance and minimal delays.

- Medium-Term: India’s response through supply diversification, manufacturing push, and regulatory overhaul could strengthen resilience.

- Long-Term: Deepening geopolitical engagement with allied nations to reduce over-reliance on strategic trade partners like China.

Conclusion

China’s assurance to address India’s needs on rare earths, specialty fertilizers, and tunnel boring machines marks a significant diplomatic and trade turnaround. However, this moment also serves as a stark reminder of enduring dependencies. As India navigates this reset, its strategy must balance immediate relief with long-term autonomy through diversification, domestic growth, and strategic diplomacy. The path ahead demands both perseverance and foresight.

China’s latest assurance on rare earths, fertilizers, and tunnel machines is a turning point for India’s economy, agriculture, and infrastructure. But this is just the beginning. Global trade moves fast, and staying updated helps you stay prepared.

Don’t miss any update that could impact India’s growth story.

- Subscribe to Vishwa Khabar for daily, accurate, and insightful news.

- Follow us on social media for real-time updates on global trade, economy, and technology.

- Enable push notifications so you never miss a critical development.