GMDC Share Price in 2025 – Riding the Mining Momentum?

Gujarat Mineral Development Corporation (GMDC), a leading state-owned mining company, has been in the spotlight in 2025 due to its impressive share price movement and strategic growth in the mineral sector. As India’s push for resource self-reliance gains momentum, GMDC’s position as a key player in lignite, bauxite, and other industrial minerals has strengthened—attracting both institutional investors and retail traders alike.

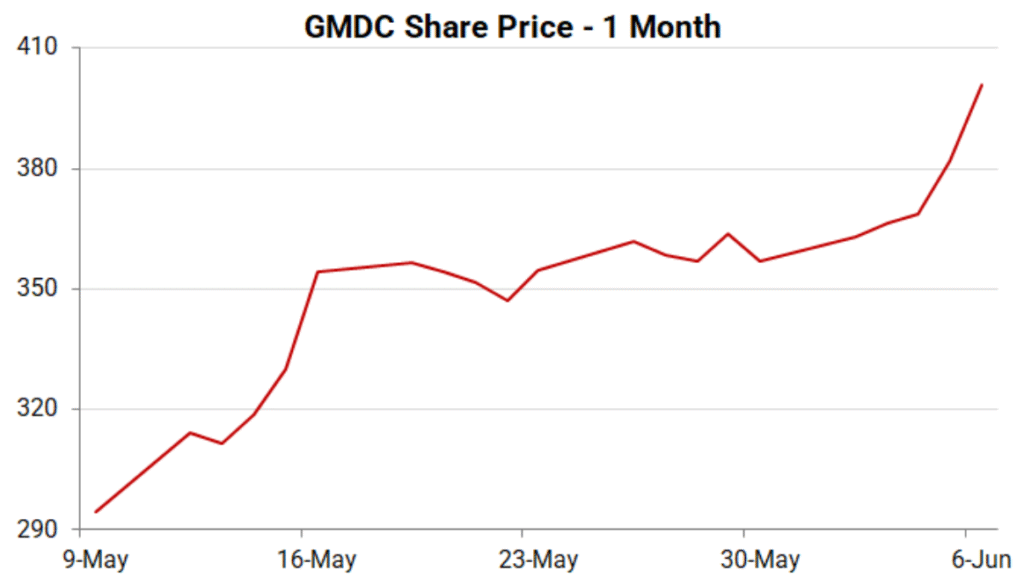

The company’s stock has delivered notable returns over the past year, backed by strong financials, expansion plans, and a government-backed thrust on domestic mining. However, market volatility, policy reforms, and global commodity prices continue to shape its share price trajectory.

1. Latest Share‑Price Surge: What's Driving GMDC?

52‑Week High & Recent Rally

- On July 18, 2025, GMDC shares soared approximately 14–17%, hitting fresh one‑year highs around ₹442 intra‑day (₹430–₹435 close range) across exchanges.

Catalyst: Rare‑Earth Magnet Crisis Attention

- News of a Prime Minister’s Office (PMO) stakeholder meeting on the rare‑earth magnet shortage, plus policy tailwinds for domestic rare‑earth processing, fueled bullish sentiment.

Volume Confirmation

- Trade volumes surged nearly 10‑fold, with ~13 million shares traded—highlighting strong institutional interest.

2. Company Profile & Strategic Position

Public Sector Miner established in 1963, based in Ahmedabad.

Mines a diverse range of minerals (lignite, bauxite, fluorspar, etc.) with captive 250 MW thermal power plant.

Actively venturing into critical minerals and rare-earth elements—allocated ₹3,000–4,000 crores for these initiatives.

Joint venture potential with NALCO for alumina processing.

3. Financial Snapshot & Fundamentals

| Metric | Value |

|---|---|

| Market Cap | ~₹13,843–13,846 Cr |

| Current Price | ~₹435 (range ₹430–443) |

| 52‑Week Range | ₹226–443 |

| P/E Ratio (TTM) | ~20.1× |

| P/B Ratio | ~1.9–2.16× |

| ROE / ROCE | ~11% / 14.2% |

| Dividend Yield | ~2.2–2.7% |

| Debt/Equity | ~0.02; virtually debt-free |

4. Recent Quarterly Performance

Q4 FY25 (ended Mar 2025):

Net sales: ₹786.3 Cr (↑4.8% YoY)

Net profit: ₹226.2 Cr (↑20.8% YoY).

EPS: ₹21.57 TTM

Three‑Year Growth:

5. Technical Analysis & Price Trends

Current Price:

- ₹435.30, +14.7% in past 24 hrs.

Volatility / Beta:

- Beta ~0.16–2.14 (mix of low systematic risk and occasional large swings).

Chart Patterns:

- Strong upward breakout with volume—bullish confirmation.

- Support at ₹420; resistance near ₹450–₹442.

Technical Forecast:

- Stockinvest.us anticipates ~31% upside over next 3 months (₹503–₹612 window).

6. Key Drivers & Prospects

Rare‑Earth & Critical Minerals Push

Transition into rare‑earth processing boosts diversification and value proposition.Government Focus & PMO Meetings

Heightened central‐level backing improves credibility and resource access.Global Supply Constraints

Chinese export curbs create demand-supply imbalances favoring GMDC.Robust Financial Performance

Strong margin expansion, debt-free balance sheet, and reliable dividends underpin valuation.

7. Risks & Challenges

Execution Risk: Scaling into rare-earth mining and value-add is capital-intensive, with regulatory and operational challenges.

Commodity Volatility: Future earnings could be sensitive to global mineral prices.

Valuation Pressure: P/E of ~20× may limit further upside without continued strong performance.

Macro Environment: A market correction could disproportionately affect mid-cap miners.

8. Investment Outlook & Strategy

Long-Term Investors

Thesis: Strategic pivot and government affiliation coupled with strong financials make GMDC a compelling structural play.

Strategy: Accumulate in phases between ₹400–₹430; target ₹520–₹550 in medium term.

Short/Medium-Term Traders

Thesis: Short‑term breakout momentum suggests swift gains, but with elevated volatility.

Strategy: Buy on dips near support (~₹420); target short swing gains near ₹450–₹480; stop-loss below ₹415.

Conservative/Dividend‑Focused

Thesis: With stable payouts and low leverage, GMDC is suitable for cautious investors.

Strategy: Detail portfolio at ₹430–₹435, with dividend yield cushion (~2.2%).

9. Comparative Peer Analysis

| Company | P/E | P/B | ROE (%) | Dividend Yield |

|---|---|---|---|---|

| GMDC | 20× | ~2× | ~11% | ~2.2–2.7% |

| Coal India | ~17× | ~1.5× | ~19% | ~6.8% |

| NMDC | ~15–18× | ~2–3× | ~12–15% | ~4–5% |

| MOIL | ~12–15× | ~1–2× | ~12% | ~1.5% |

GMDC trades at a modest premium—justified by its growth trajectory and diversification push.

10. What’s Next?

Q1 FY26 Earnings (due ~July 25, 2025) – Key driver will be early rare-earth project updates & margin progression.

Policy Announcements – Watch for incentive schemes or JV announcements in rare-earth.

Technical Breakouts – Sustained volumes above ₹442–₹450 will confirm bullish continuation.

11. Final Takeaway

GMDC is at an inflection point—transitioning from a commodity miner into a strategic player in India’s critical‑minerals landscape. Its 14–17% surge reflects policy momentum, strong earnings, and rare-earth ambitions. With solid balance sheet metrics, dividend discipline, and significant upside potential, GMDC offers a compelling mid-cap opportunity.

Growth investors: Build positions between ₹400–₹435, targeting ₹550+.

Traders: Ride the momentum with tight stop-losses, capitalizing on range moves.

Risk-averse: Use it as part of a dividend-income strategy with focus on stability.