In July 2025, U.S. Senator Lindsey Graham ignited international headlines with a blistering warning to India, China, and Brazil, threatening sweeping economic retaliation on nations continuing to import oil from Russia. What followed exposed the volatile overlap of geopolitics, energy diplomacy, and legislative escalation—all set to reshape global power dynamics.

Lindsey Graham Russian Oil Warning: Senate Pressure Hits Global Oil Buyers

A. What Graham Said

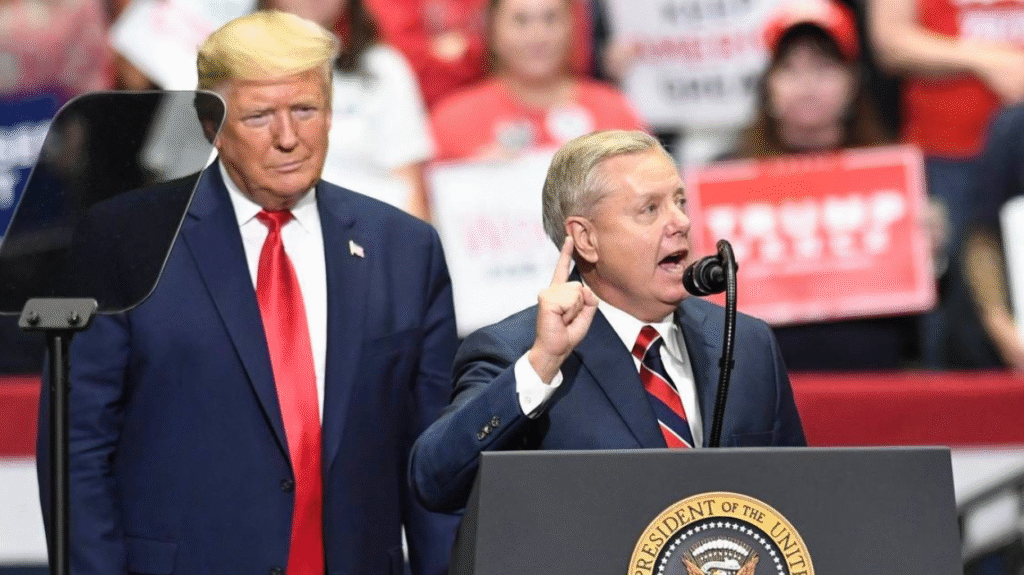

Appearing on Fox News, Graham dropped a stark ultimatum:

“Here’s what I would tell China, India, and Brazil: if you keep buying cheap Russian oil… we’re going to tear up the hell out of you and crush your economy—because what you’re doing is blood money.”

He invoked Trump-era rhetoric and foreshadowed tariffs ranging from 100% up to 500% on imports from any nation aiding Russia’s war economy.

Graham didn’t mince words in warning that the U.S. could “tariff the hell out of” these countries to compel them to abandon Russian oil purchases.

B. Legislative Weapon: The Sanctioning Russia Act

Introduced in April 2025, S. 1241, known as the Sanctioning Russia Act of 2025, was co-sponsored by Graham and Richard Blumenthal. It proposes tariffs as high as 500% on countries importing Russian oil, uranium, and petrochemicals.

The bill commands bipartisan support (≥ 80 co-sponsors) and includes a presidential waiver clause, granting Trump authority to activate or delay implementation.

Global Context: Why the Blunt Threat Now?

A. Russia Funding Its War

Russia earns approximately $160 billion annually from energy exports, underpinning its Ukraine war machine. Graham sees Western sanctions alone as insufficient and targets secondary buyers.

B. Major Buyers Under Fire

Graham specifically called out India, China, and Brazil, which together purchased up to 70–80% of Russia’s discounted oil supply—helping Russia evade primary sanctions.

C. U.S. Pressure Ramp-Up

Trump gave Russia a 50‑day ultimatum to negotiate peace, after which the U.S. would impose 100% secondary tariffs. Graham later spearheaded legislation aiming for broader measures.

Meanwhile, other Senators, including Blumenthal, explicitly labeled the proposed tariffs a “sledgehammer” economic tool.

India’s Calculus & S Jaishankar’s Response

A. India’s Energy Reality

India’s oil imports from Russia surged to 38–44% of total crude in early 2025, reaching a monthly high of 1.96 million barrels/day. That made Moscow India’s second-largest supplier.

B. Strategic Pushback

External Affairs Minister S. Jaishankar, speaking in Washington, responded with measured diplomacy:

“Regarding Senator Graham’s bill… any development… is of interest to us if it impacts our interest… we have been in touch with him… so we’ll cross that bridge when we come to it, if we come to it.”

India emphasized dialogue and energy security, while downplaying immediate policy shifts.

Why the U.S. May Take This Stance

A. Strategic Pressure

Graham’s intentions are clear: use potential trade barriers to force India and China to distance themselves from Russia or face economic fallout.

B. Congressional Momentum

The Sanctioning Russia Act, now with over 80 Senate supporters, reflects shifting sentiment on Russia policy—even across party lines.

C. Mitigating Putin’s Resilience

Though sanctions may not topple Putin, depriving him of secondary oil buyers could significantly hamper Moscow’s war financing.

Potential Consequences for India & China

A. Trade Fallout

A 500% tariff could severely harm exports from India to the U.S.—IT, pharmaceuticals, textiles—roketing prices and market access.

B. Refining Margin Compression

Even without tariffs, India’s refineries face shrinking margins as Russian discounts fade—from $6/barrel to under $3 in FY25. Loss of cheap Russian crude risks further decline.

C. Inflation & Energy Shock

Losing cheap Russian oil—or facing sanctions—could trigger fuel price hikes, inflationary pressure, and trade realignments. Analysts warn of an “oil shock.”

India–Russia Relations & Strategic Ramifications

A. Ties Rooted in Geopolitics

India–Russia relations date to the Cold War and remain anchored in defense, energy, and strategic cooperation. Moscow helped India build its nuclear and military infrastructure.

B. Currency Diversification

India is increasingly using non-dollar settlements—dirhams, rubles—for energy imports to reduce dependency. Western drill sanctions pressure these mechanisms.

C. Domestic Debate

Some Indian leaders argue that Russian oil purchases stabilize global markets. Union Minister H.S. Puri called it a global good, helping avoid price spikes.

Broader Global Implications

A. U.S.-China/India Diplomacy

This confrontation could reshape U.S. foreign policy, pressuring alliances and trade negotiations, including upcoming India–U.S. and Quad engagements.

B. Energy Economy Shifts

In response to sanctions, energy buyers might pivot to Gulf suppliers, impacting Saudi/UAE dynamics. The global oil economy stands to recalibrate.

C. Risk of Retaliation

China, India, and Brazil may respond by seeking alternate alliances or diversifying energy supply chains. Continued escalation could destabilize international trade harmony.

Legal & Political Mechanics in U.S. Sanctions

A. Bill Language & Waiver

The Sanctioning Russia Act includes executive leeway—Trump could choose whom to sanction and when.

B. Sanctions Landscape

Existing U.S. sanctions already target Russian oil producers and 183 tankers. New expansion could shift from industries to global economic partners.

C. Russian Position

The Kremlin, citing negative impacts on peace efforts, condemned the bill as counterproductive and warned that sanctions could escalate global tensions.

Key Takeaways

Political Heat from U.S.: Graham’s warning symbolizes pressure on major emerging economies to align with American sanctions policy.

High Stakes in Energy Diplomacy: India and China face a dilemma—retain discounted Russian oil or risk trade warfare.

India’s Pragmatic Posture: Jaishankar’s response emphasizes measured diplomacy amid escalating rhetoric.

Domestic Impacts: Indian refineries face shrinking profits and potential supply disruption.

Legislative Escalation: A 500% tariff bill is unprecedented and could reshape strategic energy alliances.

What's Next

Congressional Vote: The sanctions bill’s fate hinges on Senate approval and presidential action.

Diplomatic Choreography: India–U.S. and China–U.S. diplomacy will intensify in coming months.

Alternative Oil Sourcing: Gulf nations may fill demand from India and China if Russian barrels wane.

Policy Shifts: Energy ministers, trade bodies, and economists will need to recalibrate as sanctions evolve.

Conclusion

Senator Lindsey Graham’s punitive rhetoric and legislative maneuverings amount to a clear escalation: aligning energy trade with war diplomacy. India and China are at a crossroads—balancing energy affordability, strategic sovereignty, and trade relationships with a saber-rattling U.S. Whether this becomes a turning point or diplomatic bluff remains to be seen. The series of events highlight how global energy politics and legislative nationalism increasingly intersect.

As the Sanctioning Russia Act progresses and diplomats meet behind closed doors, the consequences of this standoff will ripple through trade flows, global oil markets, international alliances—and national policy choices for years to come.