PM Fasal Bima Yojana Alert: What Farmers Must Know Before July 31

What’s the Alert About?

The PM Fasal Bima Yojana alert notifies farmers that although their premium may have been auto-deducted, failure to complete critical actions—like Aadhaar updates, crop declaration, or premium remittance—will disqualify them from claim benefits. The last date for compliance is 31 July 2025 for the Kharif season.

Why This Matters: Scheme Overview & Updates

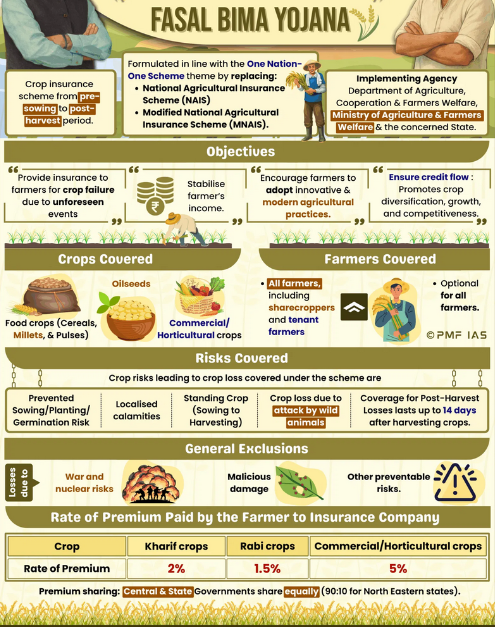

PM Fasal Bima Yojana (PMFBY), launched in 2016, is a flagship crop insurance program offering protection to farmers from natural calamities and pest damage. Over nine years, it has disbursed ₹1.75 lakh crore in claims to more than 23.22 crore farmers.

The scheme has been extended through 2025–26 with a total allocation of ₹69,515 crore, approved by the Union Cabinet. Improvements include technology integration via YES‑TECH & WINDS to streamline crop estimation and weather monitoring.

Critical Preconditions for Claim Eligibility

Farmers must complete the following by 31 July:

- Aadhaar update: Ensure your Aadhaar details match bank KYC records.

- Crop declaration: Inform the insurer or CSC of the sown crop type within deadline.

- Premium payment: Complete the premium (1.5% for Kharif, 2% for Rabi, 5% for horticulture) either online or at assigned bank/CSC.

Failure in any of these will result in loss of claim eligibility—even if premium is deducted automatically.

Regional Alerts: State-Level Deadlines

In Kalaburagi (Karnataka), local authorities have urged farmers to enroll by 31 July 2025 due to high risk from monsoon irregularities. Over 5.6 lakh farmers have previously benefited to the tune of ₹954 crore.

In Bilaspur (Himachal Pradesh), sowing-season crops like maize and paddy are covered under tickets issued with insurance up to ₹60,000 per hectare. The deadline is 15 July 2025. Farmers pay only 2% premium, while 90% cost is shared by the central and state governments.

Farmer Concerns & Scheme Challenges

States like Maharashtra have seen a 45% premium surplus—farmers paid ₹52,969 crore in premiums versus payouts of ₹36,350 crore between 2016–17 and 2023–24. Only half of insured farmers received claims.

In regions like Karnal and Kaithal (Haryana), low enrollment is linked to claim settlement delays and dissatisfaction. In Karnal, less than 4% farmers registered despite a large acreage.

Congress and farmer unions have alleged procedural delays, rejected claims due to revenue-circle-based assessments, and bias in favor of insurance companies.

Timeline & Key Highlights

| Date | Milestone |

|---|---|

| Jan 1, 2025 | Cabinet approves PMFBY continuation until 2025–26 |

| June–July 2025 | Farmers urged by states (e.g., Karnataka, Himachal) to enroll before deadlines |

| July 31, 2025 | Final date to update Aadhaar, crop selection, and premium payment for Kharif |

| August–Sept 2025 | Claims processed; delays may face 12% penalty to insurers |

How to Complete Action in Simple Steps

- Check bank statement: Confirm premium deduction by insurer.

- Visit nearest CSC or bank kiosk if your Aadhaar isn’t linked; rectify it immediately.

- Declare crop type (Kharif) via PMFBY portal or alternate channels.

- Pay pending premium if not already deducted.

- Retain receipt or confirmation as documentation for future claim requests.

Why This Alert Is Crucial

- Financial Risk: Non-compliance means losing your right to claim, even if damage occurs.

- Digital security risk: Beware of fake calls or fraudsters posing as PMFBY agents; do not share personal details.

- Policy transparency: This alert helps build awareness of loopholes, ensuring farmers get rightful compensation if they follow guidelines.

Final Thoughts

The PM Fasal Bima Yojana alert is a timely reminder that completing administrative steps is just as important as premium payment. With one of India’s largest crop insurance schemes in place and government backing till 2026, farmers must act by 31 July to safeguard their investment and livelihood.

As delays, procedural gaps, and activism by farmer unions continue to challenge PMFBY’s effectiveness, this deadline is a critical opportunity to ensure justice and clarity in India’s agricultural insurance framework.