Overview of ITR Filing Last Date 2025 for FY 2024-25 (AY 2025-26)

The Income Tax Return (ITR) filing season for Financial Year 2024–25 (Assessment Year 2025–26) officially began on April 1, 2025. Initially, only ITR‑1 and ITR‑4 forms were available; ITR‑2, 3, 5, 6, and 7 were delayed, prompting extensions. Due to delays in the release of key ITR forms, the Government of India has extended the ITR filing deadline to September 15, 2025, for individual taxpayers not requiring an audit. This move aims to provide more flexibility and reduce last-minute filing stress. Filing your ITR on time not only helps you avoid penalties and interest but also ensures quicker refunds and better financial planning.

Key takeaways:

- The ITR filing season began on April 1, 2025, with ITR-1 and ITR-4 forms made available first, followed by staggered release of ITR-2, 3, 5, 6, and 7.

- The Central Board of Direct Taxes (CBDT) officially extended the deadline from July 31, 2025, to September 15, 2025, for taxpayers not required to get their accounts audited, in view of system delays and form updates.

- This extension allows more flexibility and aims to reduce last-minute stress.

What’s The ITR Filing Last Date 2025?

| Taxpayer Category | Original Due Date | Extended Due Date |

|---|---|---|

| Individuals / HUFs (non-audit) | July 31, 2025 | September 15, 2025 |

| Audit-required businesses | — | September 30, 2025 |

| International transaction cases | — | November 30, 2025 |

| Belated/Revised returns | — | December 31, 2025 |

| Updated returns | — | March 31, 2030 (if relevant) |

- Late filing avoids penalties if submitted before September 15.

- Belated returns can be filed up to December 31, 2025, with applicable fees for delay.

Interest & Penalty Implications

- For the first time in recent history, Section 234A interest (1% per month on outstanding self-assessment tax) is waived, provided ITR is filed and all applicable tax is paid by September 15, 2025.

- Earlier concerns suggested that self-assessment tax paid after the original July 31 might attract interest; however, experts now indicate that the extended date of September 15 now serves as the de facto “due date” for these purposes, which means interest under Section 234A should not apply if taxes are paid by this revised date.

- That said, Sections 234B and 234C penalties for delayed or underpaid advance tax are still applicable if advance tax obligations are not met on time.

- Also, the extended timeline means taxpayers could now benefit from up to 33% more interest on refunds, but note: refund interest is taxable and must be declared as income.

Choosing the Right ITR Form (as per Income Tax Dept.)

Here’s a quick recap of which form to file:

- ITR-1 (Sahaj): Resident individuals with salary/pension, one house property, and income up to ₹50 lakh; other conditions apply.

- ITR‑2: For individuals/HUFs with capital gains, multiple properties, foreign income, etc.

- ITR‑3: For income from business or profession (proprietorship).

- ITR-4 (Sugam): For presumptive business/freelance income up to ₹50 lakh under sections like 44AD/44ADA.

Step-by-Step Guide: How to File ITR in 2025

1. Gather Essential Documents

- Keep ready: Form 16, AIS / Form 26AS, bank statements, interest certificates, proof of deductions (80C, 80D, HRA, etc.).

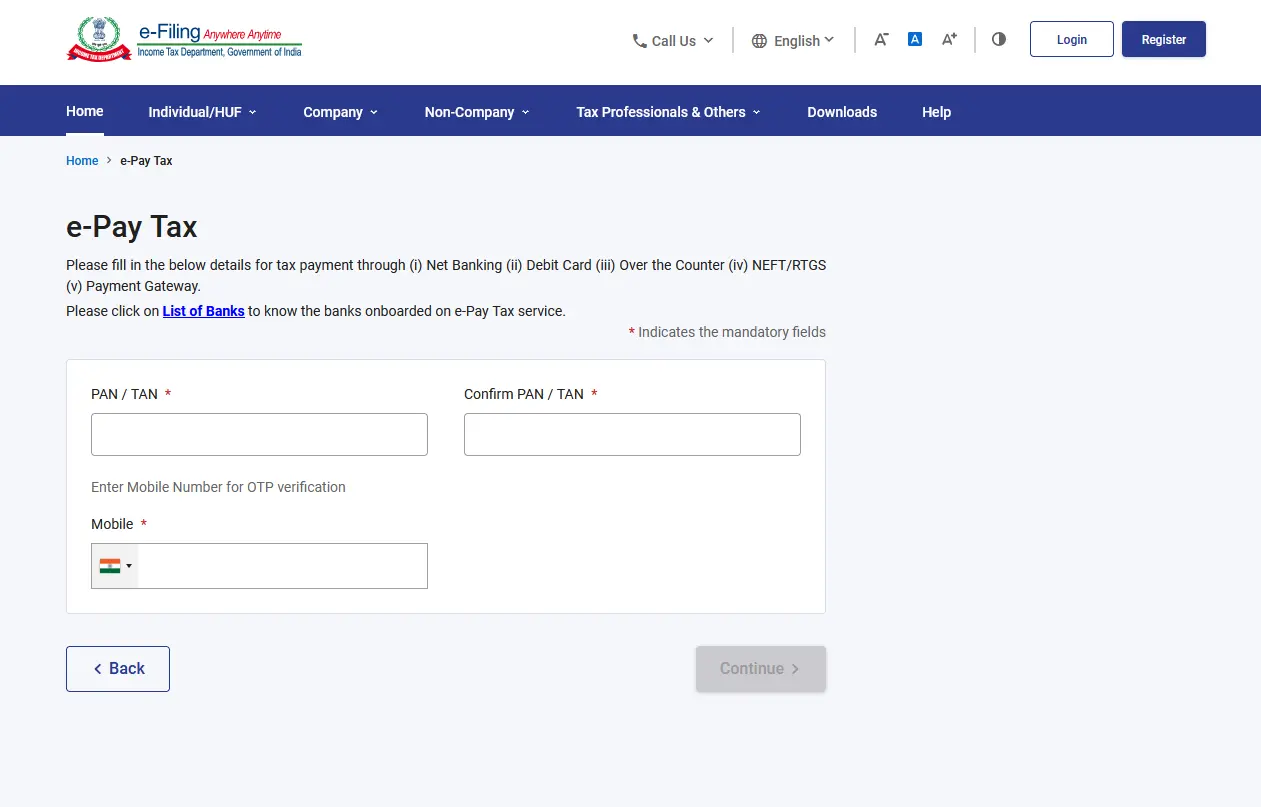

2. Log in to the Income Tax e-Filing Portal

- Access via incometax.gov.in. First-time users can register using PAN, Aadhaar, OTP, etc..

3. Select “File Income Tax Return”

- Navigate: Dashboard → e‑File → Income Tax Returns → File ITR. Choose AY 2025‑26 & Filing Mode (e‑file).

4. Pick the Correct ITR Form

- Select based on income type and eligibility. ITR‑1/ITR‑4 available now; others await utilities.

5. Pre-fill and Verify Data

- The portal fills in AIS/TDS data. Cross-check with Form 26AS and records to avoid mismatches.

6. Enter Income and Claim Deductions

- Capture full income details and deductions under sec. 80C, 80D, HRA, etc.

7. Calculate Tax and Pay

- Use “Preview & Proceed” to pay self-assessment tax via online mode before submission. Remember: paying by September 15, even if filing later, avoids 234A interest.

8. Submit & e-Verify

- Validate the form and choose e-verify: Aadhaar OTP, EVC, or net banking/DEMAT.

9. Download Acknowledgment (ITR‑V)

- Retain for your records; no need to send a hard copy if e-verified.

Finance Advice: Maximize Compliance & Savings

- File on Time (by September 15): Avoid penalties, interest, and audit flags.

- Pay Self-Assessment Tax by September 15: Safeguard against Section 234A interest.

- Don’t Overlook Advance Tax: Ensure advance tax payments are on track to avoid 234B/234C charges.

- Explore Regime Options: Evaluate old vs. new tax regimes for optimal benefits.

- Review AIS/Form 26AS: Ensure taxes deducted match income figures.

- Claim All Eligible Deductions: From 80C, 80D, HRA, etc., to reduce taxable income.

- File Early for Faster Refunds: Benefit from increased interest and faster processing.

- Keep Records: Maintain proof of all income, investments, tax payments, and receipts.

- Consider Professional Help: For complex cases (multiple sources, audits), engage a CA to avoid mistakes.

Final Takeaways

- Due Date: September 15, 2025, for most individuals (ITR‑1, 4); audit cases have different deadlines.

- No Interest Penalty: If taxes are paid by the extended deadline, Section 234A interest is waived.

- Maximize Benefits: File early, claim all deductions, and leverage increased refund interest.

- Stay Organised: Proper documentation is key to smooth filing and audits.

- Stay financially disciplined, file on time, save more, and stay compliant!

“Want the latest tax updates and finance news? Subscribe to Vishwakhabar and never miss an important deadline.”

FAQs on ITR Filing Last Date 2025

Q1. What is the ITR filing last date for FY 2024-25 (AY 2025-26)?

The last date to file ITR for individual taxpayers (non-audit cases) is September 15, 2025, after the CBDT extension.

Q2. What happens if I miss the ITR filing deadline?

If you miss September 15, 2025, you can still file a belated return till December 31, 2025, but with a late fee under Section 234F and possible loss of some benefits.

Q3. Do I need to pay self-assessment tax by July 31, 2025?

No. Since the deadline is extended, you can pay self-assessment tax and file your return by September 15, 2025, without attracting Section 234A interest.

Q4. Are penalties under Sections 234B and 234C waived, too?

No. Only Section 234A (interest on self-assessment tax) is waived till September 15. Advance tax–related penalties under 234B/234C remain applicable if payments were delayed.

Q5. Can businesses with audit requirements also file by September 15, 2025?

No. Audit-case taxpayers get a separate due date of September 30, 2025.

Q6. What is the last date for filing revised or belated returns?

The last date is December 31, 2025, for both belated and revised ITRs.

Q7. How long can I file an updated ITR?

You can file an updated return up to March 31, 2030, for FY 2024-25, but only if you have missed reporting income or need corrections.

Q8. Will my tax refund take longer if I file close to the deadline?

Yes. Filing early ensures faster refunds and avoids portal slowdowns.